Why Remote and Centralized Device Management Is Transforming IT Operations...

Read More

Saudi Arabia’s Vision 2030 is transforming every sector — with BFSI at the epicenter of this digital evolution. Between giga projects, fintech adoption, and open banking mandates, CIOs face a dual challenge: accelerate modernization while taming cloud and infrastructure costs.

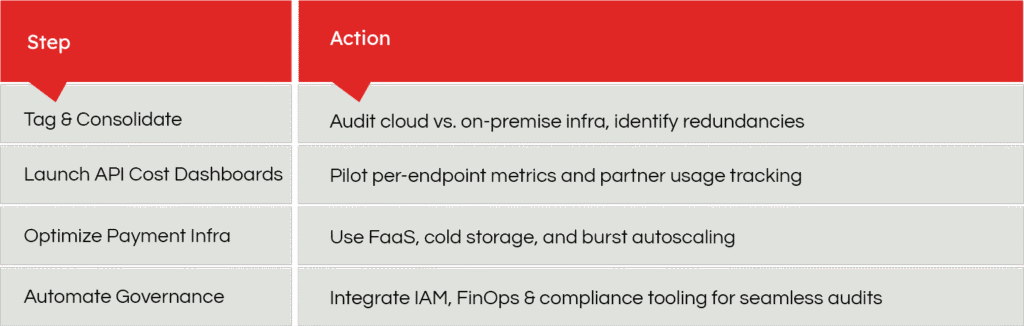

For Saudi BFSI leaders, optimization isn’t just a cost-saving exercise — it’s a compliance, agility, and national alignment mandate. This guide reveals 2025’s top tech and cost trends, the biggest overspend culprits, and four actionable FinOps tactics tailored for the Kingdom.

1. Infrastructure Consolidation & Containerization

2. Open Banking Cost Management

3. Payment Infrastructure Optimization

4. Cyber & Compliance Automation

With deep GCC experience and 24×7 NOC/SOC delivery, Softenger helps Saudi banks achieve cost transparency, resilient cloud infrastructure, and scalable FinOps maturity — aligned with Vision 2030.

Ready to align with Vision 2030 and cut IT costs by up to 40%?

Why Remote and Centralized Device Management Is Transforming IT Operations...

Read MoreGrid Modernization in the Energy & Utilities Sector: Building a...

Read MoreHome Services IT Infrastructure Streamline Your IT Ecosystem for Maximum...

Read More